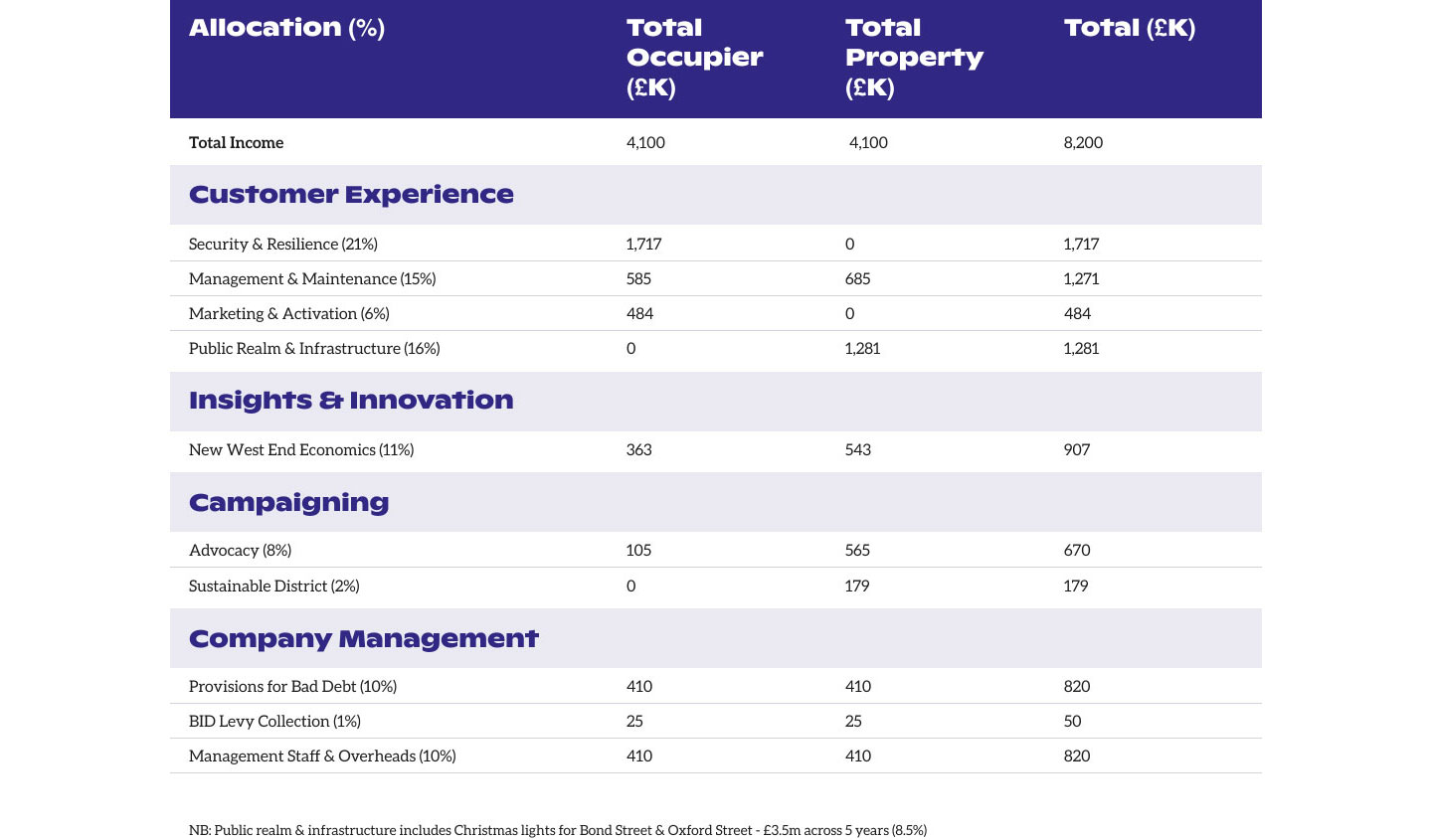

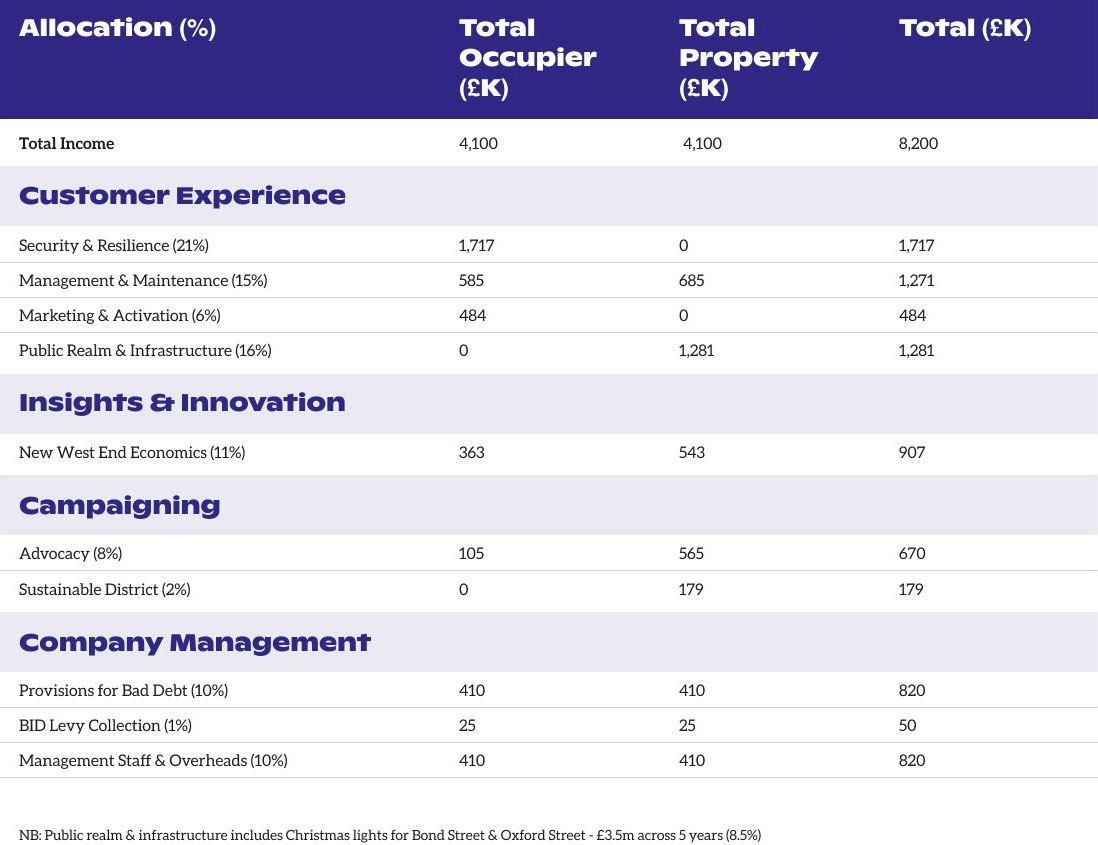

Income & Expenditure

2021/22

Income generated from the BID levy is ring-fenced to be invested in the BID area, protecting and enhancing the commercial wellbeing of our businesses through a programme of projects and services that holistically manage, promote and shape our area in line with the five-year business plan. The following allocation has been approved by the Strategic Board in consultation with members through the development of this business proposal.

Notes

Budget figures are indicative based on the anticipated levy income using 2017 Rateable Values. Assumed 3% annual inflationary increase and 100% levy collection rate. Levy income may fluctuate in relation to occupancy and is subject to the market at the time of the ratings assessment.

Allocations reflect current priorities; these may change causing variances and reallocations across the five-year term. Any material variations of the budget will be approved by the Board. Contingency based upon 10% of BID Levy.

Our management and overheads are maintained beneath the industry benchmark of 20%, currently reflecting 10% of expenditure. We seek to leverage voluntary income, which will help enable more of our members’ contributions to be allocated to work programmes, which directly benefit business and the local area in general.

Five year income projection

Five year income projection

The BID Levy increases by 3% for inflation year-on-year. All other income remains flat.

The Board have agreed percentage allocations of budget through the five-year plan to allow agility on resources and programmes based on trading conditions and business priorities. As part of our COVID recovery, there may be requirement for a budget provision for higher bad debt in the first few years of the new BID term. This amount will need approval by the Board on an annual basis.

40% - 60%

Customer experience

10% - 15%

Campaigning

10% - 15%

Insights & innovation

10%

Company management

10%

Provision for bad debt

Note

Should collection rates exceed 90%, this additional income will be ring-fenced towards the Oxford Street District project and subject to Board approval through the annual business planning process.

Empty Properties

Occupier BID: For empty properties the liability for the occupier BID levy will fall upon the liable Property Owner.

Property BID: The liable property owner will be liable for the occupier BID levy if the property is empty and in rating.

Additional Funding

Additional Funding

New West End Company will seek to grow its number of voluntary members and, in particular, leverage its activity towards the delivery of additional funding to support ongoing work programmes.

We will:

Provide additional services over and above that delivered by the BID levy in partnership with participating property owners.

Explore and grow office occupier members, and in doing so identify the appetite and service provision required for embracing the office sector as formal members of the Business Improvement District.

The additionality will be analysed and reported annually.

Target - £200k per annum (£1 million five years).